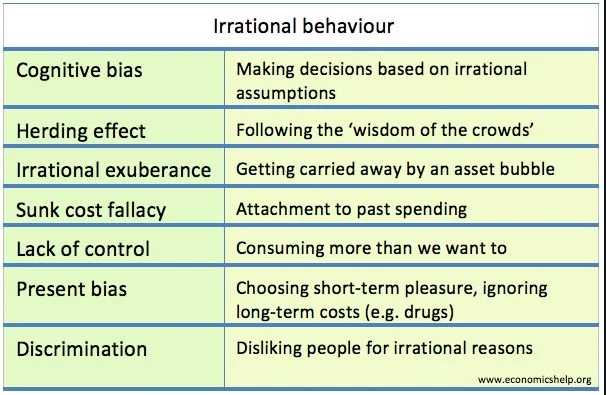

Irrational behaviour can lead to market bankruptcy, loss of economic benefit and personal issues such as drug craving and poor health. Irrational behaviour has connotation for formulating economic policy. It means economists need to take into account the potential for foolishness.

Irrational exuberance

Irrational exuberance is a term to characterize over-optimism, especially about asset bubbles. For example, if the sharing rises and people see an increment in wealth, this may boost them to keep buying more. If prices rise above their abiding value, we can think this time is different, and perhaps there is some reason for the risen value of shares. Occurrence of this exuberance ‘bubbles’ such as the “Dot Com Bubble” had happened in the late 1990s and the financial bubble of the early 2000s.

Herding is a position where individuals estimate that ‘the majority must be correct.’ Therefore, as well as we are attentive of buying shares in South Sea Company.

Cognitive bias

Occurrence of Cognitive Bias happened when the irrational decisions were taken, but often are unaware of our own foolishness. For example, we should be focusing on the study which says that one glass of red wine a day is good for health and then make the acceptance that any quantity of alcohol can be beneficial for us. While discussing, we should use ‘mental shortcuts’ or ‘heuristics’ – these decisions are based on emotional responses.