An emergency fund is a crucial component of financial stability. Unexpected expenses can happen at any time, whether it's a medical emergency, a car repair, or a job loss. Without an emergency fund, individuals may be forced to take out loans or use credit cards to cover these expenses, which can lead to a cycle of debt.

Building an emergency fund is not something that can be achieved overnight, but it is important to start as soon as possible. The amount of money an individual should have in their emergency fund will vary depending on their individual circumstances, but a general rule of thumb is to aim for three to six months' worth of living expenses.

To begin building an emergency fund, individuals should start by setting a monthly savings goal. This could be a percentage of their income, such as 10% or more, or a specific dollar amount. It's important to make this savings goal realistic and attainable, so that it doesn't become a burden on their budget.

Another way to build an emergency fund is to redirect money that would normally go towards discretionary spending. This could mean cutting back on eating out or entertainment expenses and instead putting that money towards the emergency fund. By making small adjustments to their spending habits, individuals can build up their emergency fund over time.

When it comes to where to keep an emergency fund, it's important to choose a savings account that is easily accessible, such as a high-yield savings account or a money market account. These types of accounts generally offer higher interest rates than traditional savings accounts, which can help the emergency fund grow faster.

Having an emergency fund can provide individuals with a sense of security and peace of mind. They can rest assured that they are financially prepared for unexpected expenses and emergencies that may arise. It also helps to avoid the need to rely on credit cards or loans, which can carry high interest rates and fees.

In addition, having an emergency fund can help individuals maintain their financial goals. For example, if someone is working towards paying off debt or saving for a down payment on a home, unexpected expenses can derail their progress. Having an emergency fund in place can help to prevent these setbacks and keep them on track towards their financial goals.

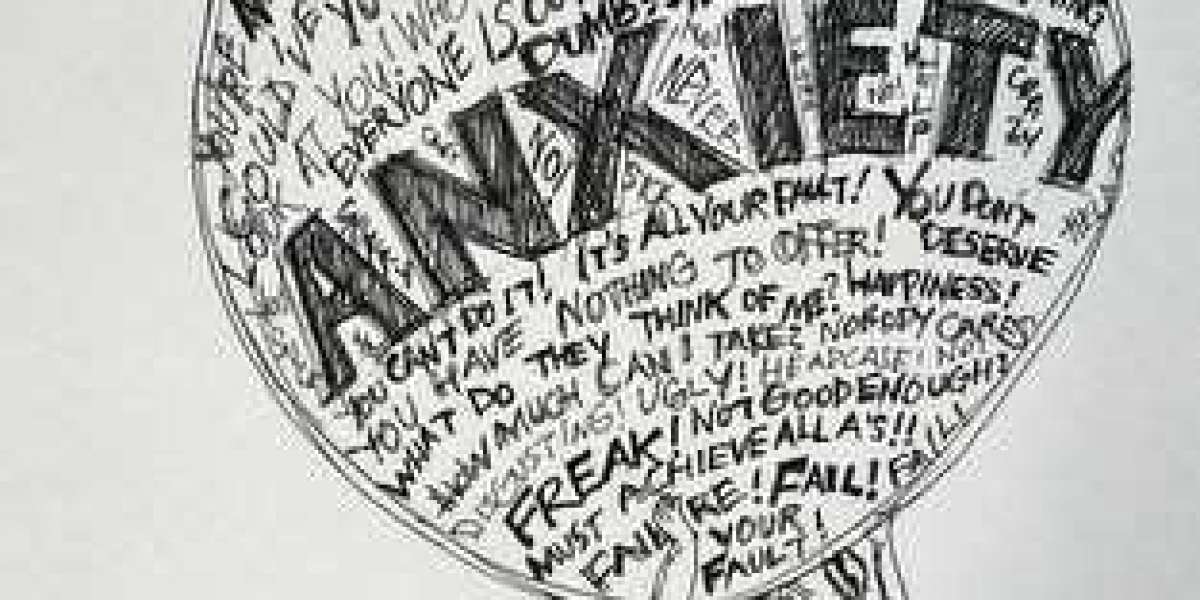

Lastly, having an emergency fund can help to reduce stress and anxiety. Financial worries can be a significant source of stress for many individuals, and having an emergency fund can provide a sense of security and stability. It can help to alleviate some of the anxiety that comes with not knowing how unexpected expenses will be covered.

In conclusion, building an emergency fund is an essential part of financial planning. It can help to provide individuals with a sense of security and peace of mind, and it can help to avoid the need to rely on credit cards or loans to cover unexpected expenses. While building an emergency fund takes time and effort, the benefits of having one make it well worth the effort.