Money is a crucial part of our daily lives. It is essential for meeting our basic needs, achieving our goals and desires, and building a sense of security for our future. However, our relationship with money is not just a rational or logical one. Our emotions, beliefs, and experiences often influence our financial decisions, sometimes leading to poor choices and financial stress.

The psychology of money is a field that explores the emotional and psychological factors that influence financial decision-making. It seeks to understand the reasons behind our financial behavior and how we can manage our finances effectively. Here are some common emotional and psychological factors that influence our financial decision-making:

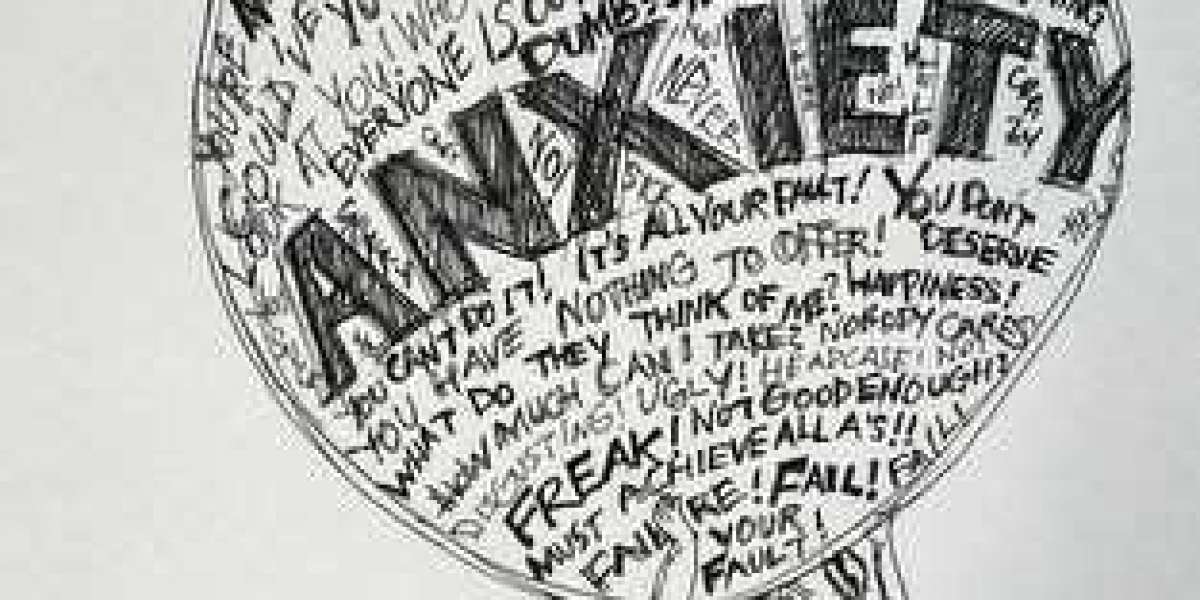

- Fear and Anxiety - Fear and anxiety can lead to impulsive financial decisions, such as buying or selling stocks in a panic or making quick purchases to ease anxiety. This can lead to poor financial decisions and unnecessary spending.

- Envy and Comparison - Social comparisons can lead to envy, which in turn can lead to overspending. We might feel the need to keep up with others' spending habits, leading to unnecessary purchases and debt.

- Self-Control - Lack of self-control can lead to overspending and poor financial choices. It can be difficult to resist temptations and make long-term financial decisions instead of immediate gratification.

- Beliefs and Values - Our beliefs and values around money can affect our financial decisions. For example, if we believe that money is the key to happiness, we may overspend to achieve that happiness.

To manage our finances effectively, we need to understand these emotional and psychological factors and develop strategies to overcome them. Here are some strategies individuals can use to manage their finances effectively:

- Develop a Budget - Creating a budget helps us understand our financial situation, prioritize our spending, and identify areas where we can save. A budget helps us make informed financial decisions and prevents impulsive purchases.

- Plan for the Future - Planning for the future helps us set long-term financial goals and make decisions that align with those goals. Saving for retirement, emergency funds, and other long-term goals helps us avoid impulsive decisions and build a sense of financial security.

- Practice Self-Control - Practicing self-control helps us resist the temptation to overspend and make poor financial decisions. Strategies like delaying gratification, avoiding impulsive purchases, and setting financial boundaries can help us develop self-control.

- Reconsider Beliefs and Values - Reconsidering our beliefs and values around money can help us make more informed financial decisions. Understanding the true value of money and how it fits into our lives can help us avoid unnecessary spending and debt.

In conclusion, the psychology of money is an essential aspect of financial decision-making. Our emotions, beliefs, and experiences play a significant role in our financial behavior, and understanding these factors is critical to managing our finances effectively. By developing strategies to overcome emotional and psychological factors and making informed financial decisions, we can build a sense of financial security and achieve our long-term goals.