The Thermoplastic Prepreg Market study by Company, Region, Product Form, Process, Resin, and Fiber; offered by Stratview Research discusses the most up-to-date market trends as well as an industry growth estimate for the next 5 years. The report covers industry profiles of key players, including market share, regional analysis, and market division, business & development strategies, mergers & acquisitions, alliances, and key financial data, etc.

Market Insights

Thermoplastic prepregs offer a series of advantages including faster part cycle time, recyclability, ease of fabrication, and excellent mechanical properties. Major aircraft OEMs: Boeing, Airbus, and Gulfstream have efficaciously started leveraging the potential of thermoplastic composites from the tail to wings to fuselage components in their latest aircraft. Though thermoset prepregs have been the perennial choice for several decades in the aerospace industry, the penetration of thermoplastic composites is likely to rise in the future with the continuous advancements in materials, technology, and processes. Major thermoplastic prepreg manufacturers are avidly working with tier players and OEMs in order to develop new applications using thermoplastic prepregs.

The outburst of COVID-19 has caused an unnerving impact on the two-key demand-generators of thermoplastic prepreg, the aerospace, and automotive industries. The aerospace industry is likely to be the hardest hit by the pandemic with the grave repercussions in the first half of 2020. Similarly, the automotive production levels are expected to slump massively in 2020, imprinting an appalling impact on the industry (Automotive production’s plummet during the Great Recession: -12.1% YoY 2008-2009 and The Great Lockdown: -22% YoY 2019-2020).

Currently, it is an arduous task to determine the real impact of the pandemic on the thermoplastic prepreg market, but factoring in the recoveries logged during the Great Recession, SARS, MERS, etc., coupled with several primaries conducted across the supply chain, Stratview Research estimates that the thermoplastic prepreg market is likely to make a healthy rebound, reaching a value of US$ 170.2 Million by 2026. Thermoplastic prepreg currently accounts for less than 5% of the global prepreg market; however, it is likely to grow at a faster rate than the overall prepreg market in the coming five years, driven by an expected recovery in the aerospace & defense and automotive industries.

Expected recuperation in the production rates of commercial and regional aircraft, such as thermoplastic composite-rich next-generation aircraft, B787, and A350XWB; rising demand for lightweight recyclable parts; reduced part cycle time coupled with the lower-processing cost of thermoplastic composite parts as compared to thermoset composite parts; and stringent regulations regarding fuel efficiency and carbon emissions in the aerospace and automotive industries are some of the key factors that will burgeon the demand for thermoplastic prepregs in the long run.

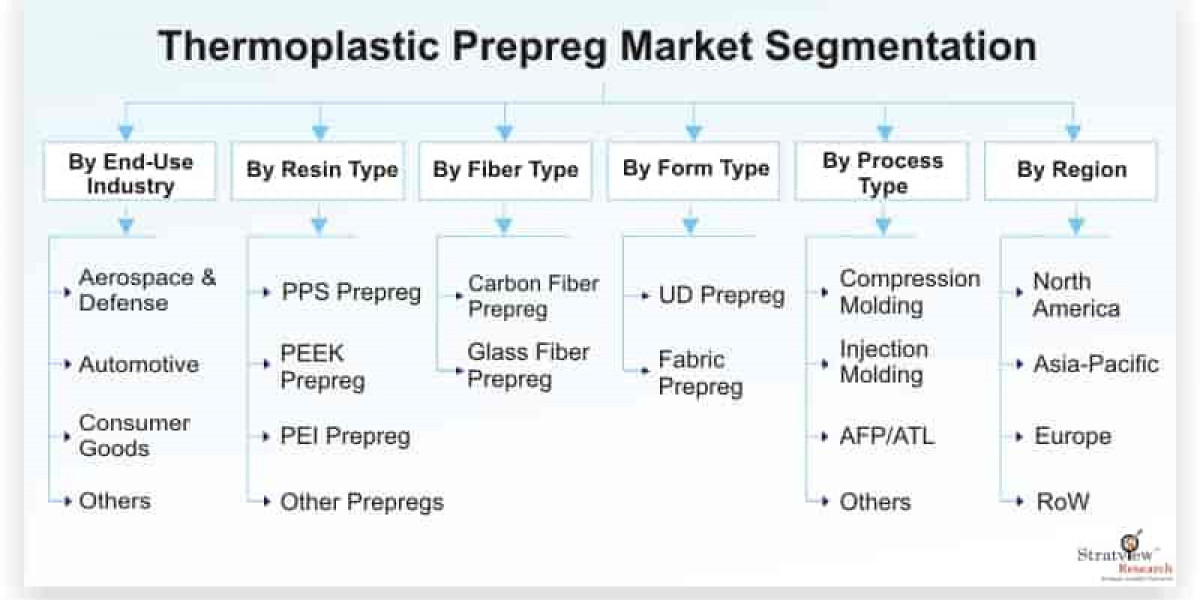

Market Segments' Analysis

The market is segmented based on the end-use industry as aerospace & defense, consumer goods, automotive, and others. Despite suffering a grave impact of the pandemic in 2020, aerospace & defense is projected to remain the most dominant segment of the market during the forecast period. Gradually rebounding the production of commercial aircraft coupled with an increase in penetration of thermoplastic composites, especially in composite-rich aircraft programs, such as B787 and A350XWB is likely to fuel the growth of the segment in the long-term. Clips and cleats used in the fuselage are the major applications of thermoplastic prepregs in these aircraft programs.

Based on the resin type, we have segmented the market as PPS, PEEK, PEI, and others. PPS resin is likely to maintain its unquestionable lead in the market, along with the fastest recovery in the post-pandemic scenario. PPS resin has good dimensional stability even at elevated temperatures and in the harsh chemical environment coupled with the advantage of the ease of molding complex parts with a tight tolerance making them the preferred material for various aircraft applications, especially in aircraft airframe. The aircraft industry is also showing a sheer interest in PEEK-based thermoplastic prepregs.

Based on the fiber type, carbon fiber is projected to remain the larger segment of the market during the forecast period. Carbon fiber offers numerous advantages, such as excellent weight reduction, high strength-to-weight ratio, high tensile and compressive strength, low coefficient of thermal expansion, and high fatigue resistance but at a very high cost. Major thermoplastic composite applications in aircraft, such as clips and cleats, are fabricated with carbon fiber-based thermoplastic prepreg.

Based on the manufacturing process type, we have classified the market as compression molding, injection molding, AFP (Automated Fiber Placement)/ATL (Automated Tape Layup), and others. Compression molding is expected to maintain its supremacy in the market. The process offers a faster part cycle time, reduced part wastage, and reduced defects, which overall leads to a lower part cost. On the other hand, AFP/ATL is likely to grow at the quickest pace during the same period, driven by increasing demand for an automated process that can lay the prepreg at a faster rate than the manual layup process and generates low void content.

In terms of regions, Europe is expected to maintain its unassailable dominance in the market, also recovering at the fastest rate during the forecast period. Airbus is one of the major consumers of thermoplastic prepregs in Europe. Major thermoplastic component manufacturers have set up their manufacturing plants in the region in order to remain proximal with the Airbus assembly plants to fulfill its current and future requirements of composite parts made with thermoplastic prepregs. North America to suffer the most severe jolt due to the pandemic, subsequently marking the fast rally. The major OEMs, Boeing and Gulfstream Aerospace, are likely to drive the demand for thermoplastic composite parts in the region in the long run.

Critical Questions Answered in the Report

What are the key trends in the Thermoplastic Prepreg Market?

How has the market (and its various sub-segments) grown in the last five years?

What would be the growth rate in the next five years?

What is the impact of COVID-19 on the market?

What are the key strategies adopted by the major vendors to lead in the Thermoplastic Prepreg Market?

What is the market share of the top vendors?

About Us

Stratview Research is a global market research firm helping its users tract the ever-evolving market scenarios through its top-notch market reports. It offers the most granular market segmentation across all industries. Connect with Stratview Research, for any queries at –

E-mail: [email protected] Direct: +1-313-307-4176